You're Probably Wrong On 100% Stocks

ignore the clickbait Gaussian distribution meme; also, volatility is not a coherent measure of risk

I.

Last year, a big paper on retirement made the waves of internet finance; the researchers compared portfolios diversified across asset classes (bonds and stocks) against one 100% in equities. As expected, the all-stock portfolio outperformed the diversified portfolio on average. Stocks do, after all, have higher expected returns.

What surprised many people was the fact that the all-equity portfolio had a lower risk of ruin (i.e., being wiped out during retirement) compared to the portfolio with bonds. Shouldn’t bonds provide a hedge through fixed income?

Well, the paper says no! Stocks have higher expected returns that compound yearly and result in not just wealthier portfolios, but greater returns investors can draw from. Scott Cederburg, one of the paper’s authors, also argues that bonds have higher correlations with stocks over longer time horizons than commonly assumed, negating the diversification benefits.

A lot of people will be moved by the wealth of empirical evidence the paper presents. But others, like Cliff Asness of AQR and Karsten Jeske of Early Retirement Now, aren’t so convinced.

II.

You can read the articles linked above if you want to understand their main points in their own words, but it basically comes down to a few critiques:

Asness argues that since returns should generally be maximized given their risk level, a 100% equity portfolio is suboptimal due to their lower Sharpe ratio. Investing in a more diversified portfolio (e.g. 60% stocks, 40% bonds) levered at the risk-free rate can theoretically offer either higher returns at the same risk or lower risk at the same returns.

Jeske points out a few problems with the methodology and also presents historical examples where 100% equities would have caused severe problems.

He further says that a portfolio of 100% stocks violates the Bellman Principle of Optimality and should be far more dynamic!

All of these points have merit. In fact, I wholeheartedly agree with the second point and believe the third point is probably true for most investors. However, Concerning Asness’s point, there’s an implicit assumption that risk should be measured as the portfolio’s volatility; even I implied it in my previous paragraphs. Both Asness and Jeske go as far as saying risk is volatility!

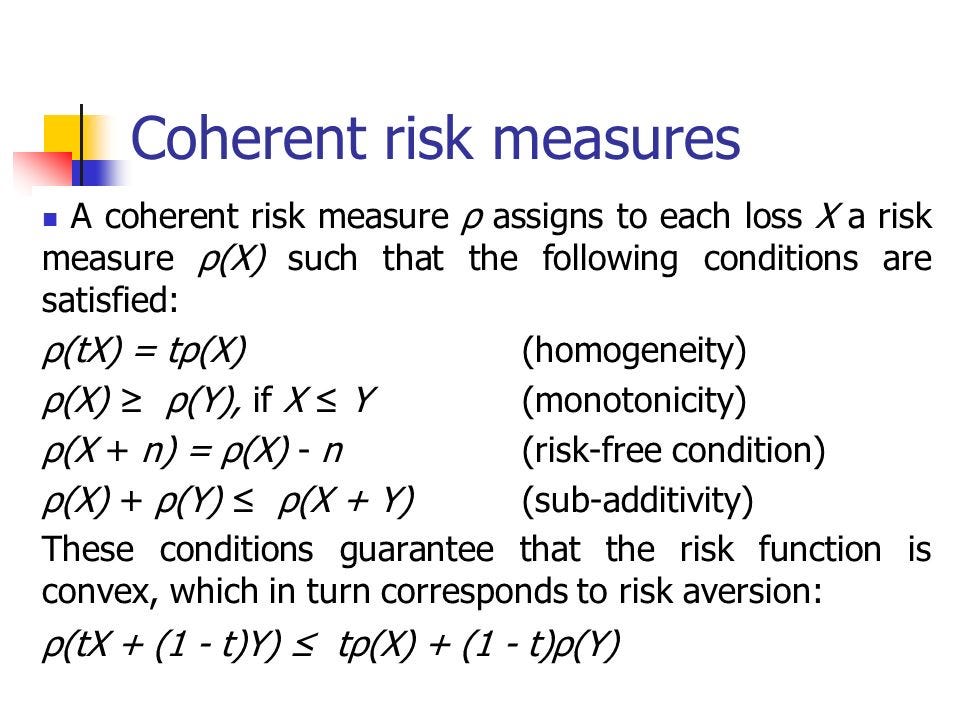

But that needn’t be the case. For one thing, volatility is not a coherent measure of risk. I’m not going to bother with explaining the basic axioms of coherence, but understanding all four of them will help make my main point clear.

Essentially, volatility violates the second condition, monotonicity. One example that might strengthen our intuitions on this is to compare the volatility of cash against that of T-bills. T-bills are “less risky” than cash because they guarantee higher returns, but clearly face higher variance than the latter. This misrepresents the risk profile of each asset class and could cause a particularly risk-averse investor to misallocate their funds towards more cash just to see that little sigma go down with no actual reduction in risk whatsoever!

III.

You might wonder why coherence is important to begin with. It matters because it focuses on what we actually care about, maximizing expected utility.

To maximize expected utility, we must accept most axioms of rational choice theory and therefore have coherent risk measures. By modus tollens, if we postulate volatility or variance as risk for investment problems, we won’t always maximize expected utility.

From this, one might conclude that higher Sharpe ratios won’t offer lower risk-per-return, and using coherent risk measures will result in meaningful (and beneficial) changes in asset allocation for a majority of investors. Well, if you assumed that, you aren’t necessarily right!

The mean-variance optimal portfolio is also the one that maximizes expected utility assuming constant relative risk aversion and lognormally distributed security returns. Maybe Nobel laureates Stiglitz, Merton, Fama, Samuelson, and all the other academic finance giants were right all along? Nah! I’m sure the guys all in on stocks will beat ‘em!1

Okay, let’s cut back a bit and try to process the information. Maximizing expected utility leads us to seek a coherent risk measure, but volatility, a risk measure that’s not coherent, is part of the solution for investors with power utility functions assuming normally distributed stock returns. How is this consistent?

To understand this apparent discrepancy, we must first understand the problem with volatility mentioned earlier, monotonicity. One can have one security dominate another but have higher variance and thus an increased perception of risk without increased intrinsic risk. But so long as security prices are lognormally distributed, as is assumed in most mean-variance problems, volatility will rarely violate this property and therefore be coherent in such a scenario.

This leads to the perceived contradiction of mean-variance solutions being optimal in certain situations even if the measures used in the analysis do not always lead to rational choices. In reality, the contradiction isn’t necessarily real since mean-variance analysis can be optimal for myopic investing but suboptimal in contexts where assets do not follow lognormal distributions or when investors have risk preferences significantly different from the norm, e.g. someone who prefers greater variance in asset returns.

To expand on the last point, mean-variance analysis posits that risk is assumed to be traded off for return and is inherently undesirable without adequate compensation. This is generally true for most people, but greater variance can be quite desirable for risk-seeking investors as their utility functions are convex!

IV.

What should we conclude from this? I think we should all agree that a portfolio comprising equities will usually have lower Sharpe ratios and higher variance than portfolios with fixed-income positions. Modern portfolio theory says this. All historical evidence says this. The Golden God, Cliff Asness says this. Okay, that’s one less thing to start a war over.

A second point we can all (hopefully) agree on is that investors should not only diversify, but diversify to hedge against risks they face outside of securities, whether it be through their illiquid investments, labor income, or fixed income outside of bonds (e.g. pensions and social security). This usually indicates that 100% stocks is suboptimal for most investors, especially as their human capital (a source of “wealth” typically less risky than stocks) decreases with age.

Of course, some investors will be perfectly fine with a portfolio of only equities. But “fine” is a far cry from “optimal.” Okay, that’s two less things to start a war over.

Thirdly, just because something looks suboptimal doesn’t mean it is. This goes for stocks just as much as it does for using volatility as a unit of risk. Stocks will have lower Sharpe ratios than the market portfolio, and the Sharpe ratio is also not a universally good metric to go by. Both of these statements are true and don’t suffice to contradiction.

Fallacious thinking, especially in finance, can lead to severe mistakes in one’s decision-making. Okay, that’s three less things to start a war over.

Regardless, I do believe that there are some important points of disagreement that the finance community ought to take note of:

Volatility is an imperfect measure of risk. It’s not coherent. It’s “too short-term.” It’s not necessary for utility maximization. However, it’s still useful for investors with isoelastic or quadratic utility, and other contexts as well.

Investors who believe portfolio returns do not follow such distributions2 should therefore use better, coherent risk measures like expected shortfall and CVaR deviation to consider tail risk, and accordingly, hold different portfolio compositions than if they used volatility. These measures are hard to estimate and even harder to optimize for, but it could be worth it given the importance of coherence to rational choice.

As Cederburg said, bonds may have higher correlations with stocks in the long run. His description is technically correct, but his normative conclusion is (ironically) shortsighted. A myopic solution involving volatility still reduces to the optimal one for most long-term investors regardless of the time horizon, even though volatility is not coherent.

As a corollary, the Sharpe ratio becomes useful for certain investors and should probably be maximized if levering at the risk-free rate is permitted. Investors who can’t borrow at lower rates may look at levered ETFs instead.

Asness correctly pointed out that the paper made large leaps of logic that don’t make economic sense, specifically that improved portfolio allocation for the individual would translate to welfare improvements for society as a whole. An improvement for the individual does not always result in an improvement for the group. These kinds of mistakes in economic reasoning are disheartening to see occur, especially coming from finance researchers.

Finally, both Cederburg and his critics are generally correct in describing the theoretical finance landscape and the historical returns of various portfolios. However, they commit errors in broadly prescribing portfolio heuristics when such a thing depends on the investor’s preferences. Cederburg’s critics make big assumptions about the utility function in prescribing that risk should be minimized given a constraint on return; those assumptions imply choices unsuitable for people with different tastes. Cederburg himself makes even worse errors by assuming that reduced long-term portfolio risks necessarily change the optimal allocation and that such insights could lead to welfare improvements for society.3

Ultimately, I agree more with the paper’s critics than I don’t. Some practical constraints make levering an efficient portfolio impractical, but that doesn’t mean all equities is the way to go for those with higher risk tolerance!

Anyways, because I’m late for dinner, and because I don’t know how to end this post, I’ll practice my chops for math textbook writing and leave the practical implications as an exercise to the reader. #notfinancialadvice

You think I’m being sarcastic? 100% stocks produces higher returns over longer time horizons with p approaching 1. By the same logic, we should all go full max Kelly!/s

Also known as investors who deadlift.

John Cochrane has long said that, unlike other free markets, the market for financial alpha is essentially a zero-sum game. Why would shifting the allocations of target-date funds and the like improve aggregate economic outcomes? There’s no further information being discovered by the trading, and every trade must “cancel” each other out.